When importing products to sell on Shopify, one crucial step you can’t overlook is identifying the correct Harmonized Tariff Schedule (HTS) code. The HTS code determines the import duty, taxes, and regulations that apply to your shipment. This guide will help Shopify sellers understand HTS codes, why they matter, and how to find them.

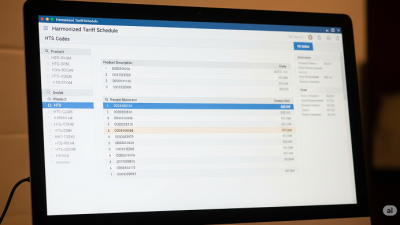

What is an HTS Code?

The HTS code is a numerical classification system used worldwide to identify traded products. Each product type is assigned a specific code that customs authorities use to determine import duties, taxes, and restrictions.

- Example: A ceramic coffee mug may have a different HTS code than a stainless steel water bottle.

- HTS codes are standardized at the first 6 digits internationally, with additional digits varying by country.

Why Shopify Sellers Need HTS Codes

If you’re running a Shopify store and importing products from overseas suppliers (e.g., Alibaba, AliExpress, or other wholesale marketplaces), you must declare the HTS code when the goods enter your country.

Reasons it’s important:

- Avoid Customs Delays: Incorrect codes can result in inspections or shipment holds.

- Accurate Duty Calculation: Determines how much import tax you pay.

- Compliance: Failure to use the correct HTS code can lead to penalties.

How to Find the Right HTS Code for Your Products

- Use the Official HTS Database: Many countries, including the U.S., have an online searchable HTS database.

- Ask Your Supplier: Many experienced suppliers can provide the correct HS/HTS code.

- Consult a Customs Broker: Professional brokers ensure your code is accurate for your product category.

Example HTS Codes for Shopify Products

| Product Type | Example HTS Code | Duty Rate* |

|---|---|---|

| T-Shirts (Cotton) | 6109.10 | 16.5% |

| Sunglasses | 9004.10 | 2.5% |

| Wireless Earbuds | 8517.62 | 0% |

| *Duty rates vary by country. |

Best Practices for Shopify Imports

- Double-check your codes before shipment.

- Keep detailed product descriptions for customs.

- Stay updated on changes in tariff schedules.

Conclusion

For Shopify importers, getting the HTS code right is not just a formality—it’s essential for smooth, cost-effective importing. By using accurate codes, you avoid delays, control costs, and maintain compliance with trade laws.

We work with trusted global freight forwarders. Get a quote to ship your product abroad!

Contact us now to get connected or receive a quote within 24 hours! Visit our products page for all our products.