Importing electronics can be a profitable business, but it also comes with strict regulations and customs procedures. One of the most important requirements is knowing the correct HTS code for electronics import. This code determines your import duties, compliance documents, and even whether your goods get held at customs.

In this article, we’ll guide you through everything you need to know about classifying electronics under the right HTS code.

📦 What Is the HTS Code for Electronics?

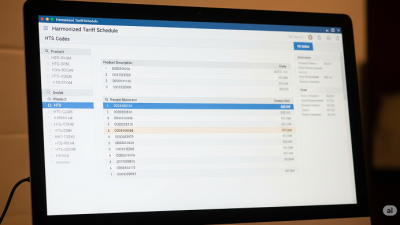

The HTS (Harmonized Tariff Schedule) code is a 10-digit number used by customs authorities to classify products being imported. For electronics, these codes fall under Chapter 85 and Chapter 90 of the tariff schedule, which cover:

- Electrical machinery and equipment

- Electronic components

- Sound and video equipment

- Measuring and testing instruments

Example HTS codes for electronics:

- 8542.31.0001 – Electronic integrated circuits, processors

- 8528.72.6400 – LCD monitors for automatic data processing

- 8504.40.9580 – Power supplies and adapters

🛠️ How to Identify the Right HTS Code for Your Electronic Product

To classify your product correctly, follow these steps:

- Describe the product in detail

Include function, components, voltage, screen size (if applicable), intended use, etc. - Determine the general product category

For example: smartphone, monitor, microchip, camera. - Use trusted resources

Visit hts.usitc.gov, WCO HS database, or consult a customs broker. - Match product features to HTS subheadings

Ensure your code reflects specific characteristics like:- With or without video capability

- Screen size (for monitors)

- Power output (for power supplies)

⚠️ Common Mistakes in Classifying Electronics

Incorrect HTS classification can result in:

- Overpayment or underpayment of duties

- Customs clearance delays

- Penalties or seizure of goods

Common errors include:

- Using general codes instead of specific subheadings

- Ignoring technical specs like power rating or screen size

- Copy-pasting codes from unrelated products

💵 Duties and Taxes Based on HTS Code

Each HTS code has an associated duty rate. Some electronics may be duty-free, while others carry tariffs depending on:

- Country of origin

- Product type

- Trade agreements (e.g., GSP, MFN rates)

Use the HTS database to view the “General” and “Special” duty rates for each code.

🌐 HTS Code and E-commerce Platforms

If you sell electronics on platforms like Amazon, AliExpress, or Shopify, you still need the correct HTS code when importing to your country. Many logistics providers (like DHL, UPS, FedEx) offer HS/HTS lookup tools.

📌 Conclusion: Accurate HTS Code = Smooth Import Process

The correct HTS code for electronics import ensures:

- Accurate customs documentation

- Proper duty payment

- Fast and smooth customs clearance

Don’t rely on guesswork. Use official databases or speak to a professional if unsure.

We work with trusted global freight forwarders. Get a quote to ship your product abroad!

Contact us now to get connected or receive a quote within 24 hours! Visit our products page for all our products.